38 calculating tax math worksheets

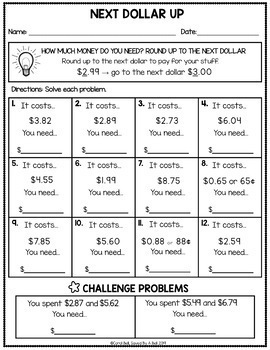

Money Worksheets With Tax | Teachers Pay Teachers Worksheets and Task Cards Add Subtract Next Dollar Up and Calculate Sales Tax by Carol Bell - Saved By A Bell 19 $27.25 $21.75 Bundle Zip SHOPPING MADE FUN and EASY! This product simulates a real shopping experience for kids who are working on functional math skills using super engaging TASK CARDS and NO PREP! Income Tax Worksheets Teaching Resources - Teachers Pay Teachers Taxes: Gross & Net Income Budget Calculation Worksheet by Elena Teixeira $1.75 Word Document File This worksheet will take your students through a step-by-step simulation of calculating their net income from a gross income starting point.

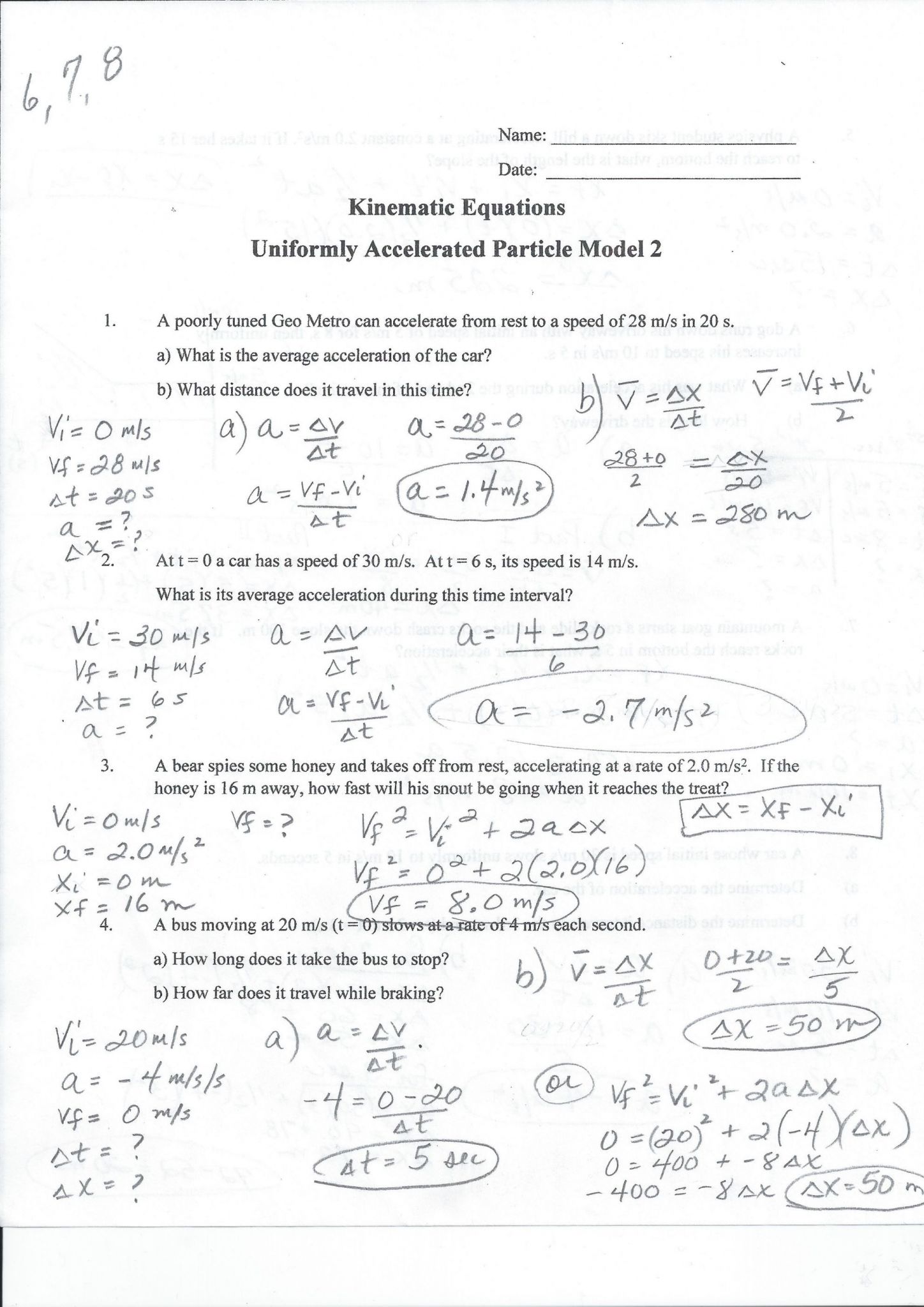

Seventh Grade / Calculating Sales & Income Taxes - Math4Texas 7.13 Personal financial literacy. The student applies mathematical process standards to develop an economic way of thinking and problem solving useful in one's life as a knowledgeable consumer and investor. The student is expected to: (A) calculate the sales tax for a given purchase and calculate income tax for earned wages.

Calculating tax math worksheets

Calculating Tax Worksheet Teaching Resources - Teachers Pay Teachers This resource is great for students who need practice calculating tax, gratuity and discounts from word problems. Problems include scenarios where students are given a total amount of a bill, tax and gratuity percent, and students need to calculate the final amount. Students should know which to calculate first, second, and so on… › resources › lessonsAlgebra Help - Calculators, Lessons, and Worksheets - Wyzant ... Need to practice a new type of problem? We have tons of problems in the Worksheets section. You can compare your answers against the answer key and even see step-by-step solutions for each problem. Browse the list of worksheets to get started… Still need help after using our algebra resources? Connect with algebra tutors and math tutors ... PDF Sales Tax Practice Worksheet - MATH IN DEMAND Worksheet Practice Score (__/__) Directions: Solve the following problems on sales tax. Make sure to bubble in your answers below on each page so that you can check your work. Show all of your work! 2 3 4 6 7 1If a table costs $45 and the sales tax is 5%, what is the sales tax? 0.05 Sales Tax = $2.25

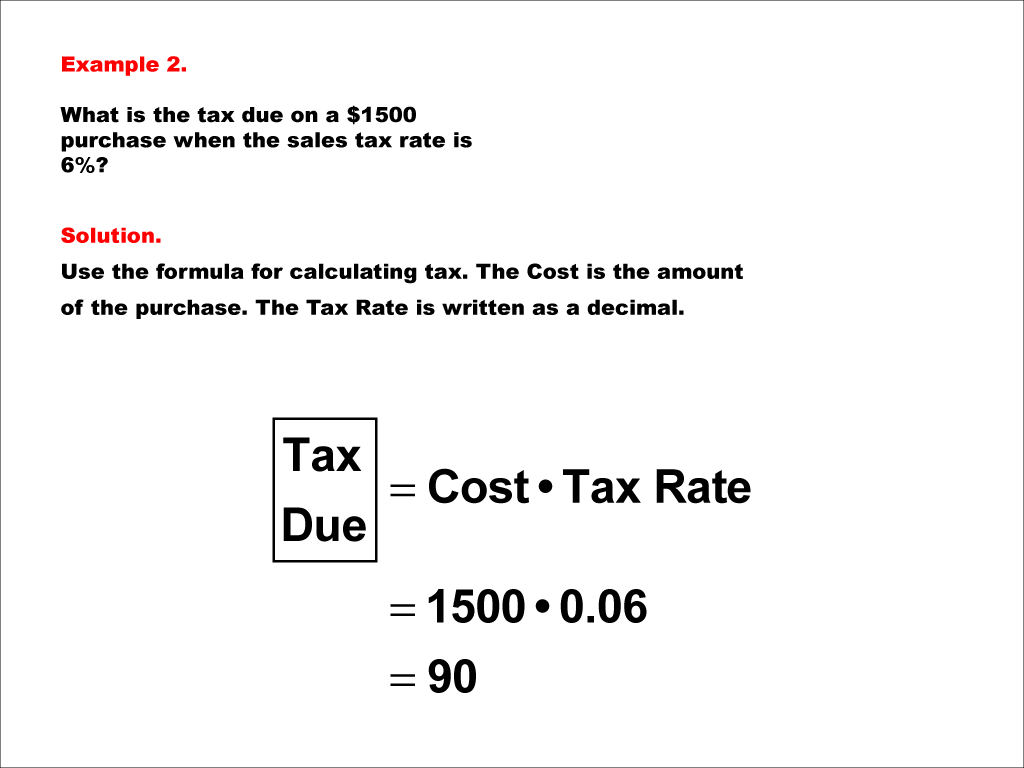

Calculating tax math worksheets. Sales Tax - FREE Math Lessons & Math Worksheets from Math Goodies Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer's cost. Solution: 2.36 ÷ $32.00 = 0.0735. Sales tax was charged by the department store at a rate of 7.375%. Answer: Mr. Smith should pay the department store $32.00 plus $2.36 in sales tax for a total bill of $34.36. Percents Worksheets - Math-Drills Welcome to the Percents math worksheet page where we are 100% committed to providing excellent math worksheets. This page includes Percents worksheets including calculating percentages of a number, percentage rates, and original amounts and percentage increase and decrease worksheets.. As you probably know, percents are a special kind of decimal. › retirement-plans › self-employedSelf-Employed Individuals – Calculating Your Own Retirement ... Nov 05, 2021 · the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees’) retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans. Income Tax worksheet - Liveworksheets.com ID: 1342388 Language: English School subject: Math Grade/level: Secondary Age: 11-18 Main content: Income Tax Other contents: Percentages Add to my workbooks (5) Download file pdf Embed in my website or blog Add to Google Classroom

PDF Discount, Tax and Tip - Effortless Math Math Worksheets Name: _____ Date: _____ … So Much More Online! Please visit: EffortlessMath.com Discount, Tax and Tip Find the selling price of each item. Finding the rate of a tax or commission: Worksheets Finding the rate of a tax or commission: Worksheets. Welcome to the Finding Percents and Percent Equations Worksheets section at Tutorialspoint.com. On this page, you will find worksheets on finding a percentage of a whole number, finding a percentage of a whole number without a calculator: basic & advanced, applying the percent equation ... Markup, discount, and tax - FREE Math Worksheets A lot of "real-life" math deals with percents and money. You will need to know how to figure out the price of something in a store after a discount. You will also need to know how to add tax to your items to make sure you brought enough money! If PDF Lesson 3 v2 - TreasuryDirect calculate tax rates (percents) and the dollar amount of taxes. 7. read and understand tax tables. Mathematics Concepts computation and application of percents and decimals, using and applying data in tables, reasoning and problem solving with multi- step problems Personal Finance Concepts income, saving, taxes, gross income, net income

Applying Taxes and Discounts Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ... Calculating Total Cost after Sales Tax worksheet Close. Live worksheets > English > Math > Percentage > Calculating Total Cost after Sales Tax. Calculating Total Cost after Sales Tax. Finding Sales Tax and Total Cost after it is applied. ID: 839531. Language: English. School subject: Math. Grade/level: Grade 5. Age: 7-15. softmath.com › math-com-calculator › distance-ofY-intercept calculator - softmath Math worksheets on number line for 3ed grade, slope formula with graph, what is a symbolic method, glencoe-mcgraw hill worksheet answers for 6-3. Free factoring and multiples worksheet, factor the quadratic expression calculator, free download of a TI-84 Plus calculator, free online beginning algebra for dummies/and answers. How to Find Discount, Tax, and Tip? (+FREE Worksheet!) Download Discount, Tax and Tip Worksheet Answers \(\color{blue}{$220.00}\) \(\color{blue}{$420.00}\) \(\color{blue}{$540.00}\) \(\color{blue}{$275.00}\) ) Reza. Reza is an experienced Math instructor and a test-prep expert who has been tutoring students since 2008. He has helped many students raise their standardized test scores--and attend the ...

Quiz & Worksheet - How to Calculate Property Taxes | Study.com Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000 $18,750 $21,570...

Tax Worksheets Teaching Resources | Teachers Pay Teachers Reinforce calculating tax and tip and the total bill with this nine question worksheet. Students are given ample space to show their work on the real-world problems. The problems increase in difficulty as the students navigate through the worksheet. Save 20% by purchasing this resource in one of my related bundles.

How to calculate taxes and discounts | Basic Concept ... - Cuemath There are two types of taxes: direct tax and indirect tax. In this lesson, we will study the tax computation when the selling price or price before tax is given. We calculate tax on a product by multiplying the tax rate with the product's net selling price. Tax amount = \($(S.P. \times \dfrac{Tax\ rate}{100})\)

› taxesTaxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

PDF Sales Tax and Discount Worksheet - psd202.org Tax: A tax on sales that is paid to the retailer. You need to add the sales tax to the price of the item to find the total amount paid for the item. Procedure: 1.The rate is usually given as a percent. 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price.

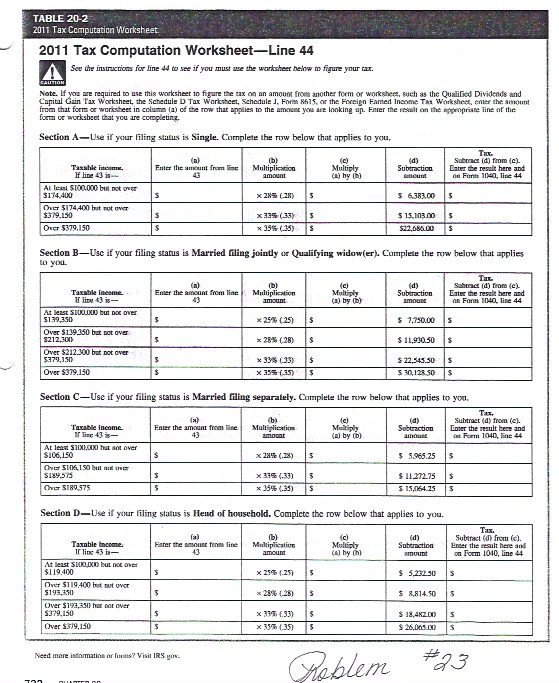

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet In those instructions, there are two worksheets which together calculate your tax. First, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which separates your total qualified income (line 4) from your total ordinary income (line 5), so they can be taxed at their different rates.

Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Free Worksheet See in a set (11) View answers Add to collection

Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Taxes & Discounts: Calculations & Examples. Worksheet. 1. Mary buys a pair of jeans for $24.99, a skirt for $32.99 and a pair of shoes for $49.99. She has a coupon for 15% off the most expensive ...

› math › grade-6IXL | Learn 6th grade math Set students up for success in 6th grade and beyond! Explore the entire 6th grade math curriculum: ratios, percentages, exponents, and more. Try it free!

Calculating Sales Tax Ontario Worksheets & Teaching Resources | TpT Math Moji Digital Calculating Sales Tax Online Game 2020 Ontario Math Curriculum. by. Dr SillyPants Classroom Resources. 3. $4.50. Zip. Google Apps™. Internet Activities. The Math Moji Digital Series is an online, interactive game series that students can play independently in the classroom or as part of at home study.

Calculating a Sales Tax Lesson Plan, Worksheet, Classroom Teaching Activity Lesson - Calculating Sales Tax Lesson (see below for printable lesson). Lesson Excerpt: Many states in the United States have a sales tax. How can we calculate a sales tax? First, we need to think about what a sales tax actually is. A sales tax is an extra amount of money beyond the original price.

› math-topics › percent-problemsHow to Solve Percent Problems? (+FREE ... - Effortless Math How to Find Discount, Tax, and Tip; ... Exercises for Calculating Percent Problems ... 7th Grade WVGSA Math Worksheets: FREE & Printable ...

PDF Worksheet: Calculating Marginal vs. Average Taxes Worksheet, with ... Worksheet: Calculating Marginal vs. Average Taxes Worksheet, with answers (Teacher Copy) Federal Tax Brackets and Rates in 2011 for Single Persons From: To: Taxed at Marginal Rate of: $0 $8,500 10% $8,501 $34,500 15% $34,501 $83,600 25% $83,601 $174,400 28% $174,401 $379,150 33% $379,151+ 35%

Adding Taxes Using Percentages - WorksheetWorks.com WorksheetWorks.com is an online resource used every day by thousands of teachers, students and parents. We hope that you find exactly what you need for your home or classroom!

› worksheets › decimal-numbersBrowse Printable Decimal Worksheets | Education.com Our decimals worksheets and printables help shine a little light. With activities to help calculate sales tax, round to the nearest dollar, and more, your young learner will be confident in their math skills in no time. Decimals worksheets and printables use word problems, riddles, and pictures to encourage a love for math.

PDF Tribal Taxes Math Worksheet - Oregon.gov Tribal Taxes Math Worksheet (Continued) Step 4 Use the table and/or chart above to write a piecewise function to calculate actual federal income taxes owed for a given income. x = Income in dollars T(x) = Federal income tax owed (by a single taxpayer) Step 5 Use your piecewise function to calculate how much John owes in federal income taxes.

0 Response to "38 calculating tax math worksheets"

Post a Comment